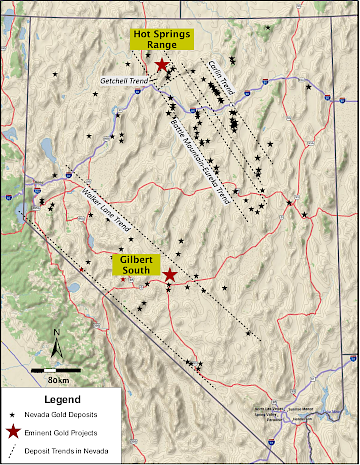

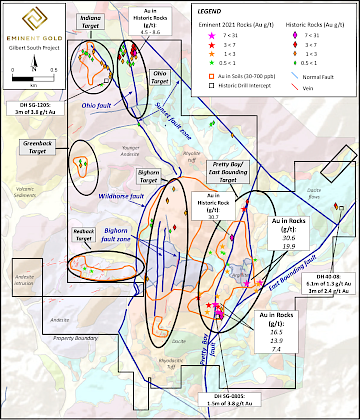

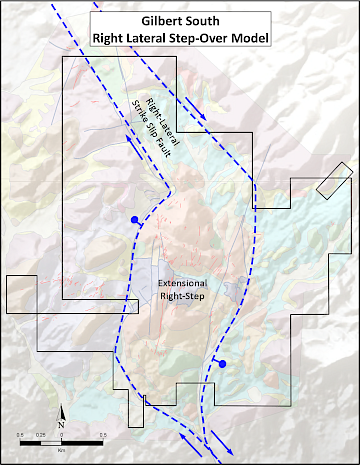

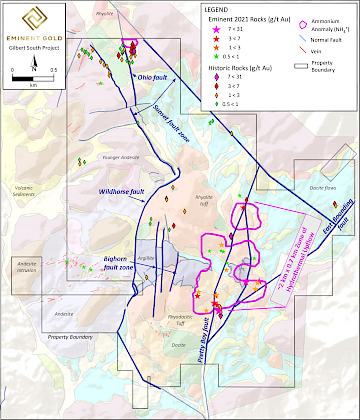

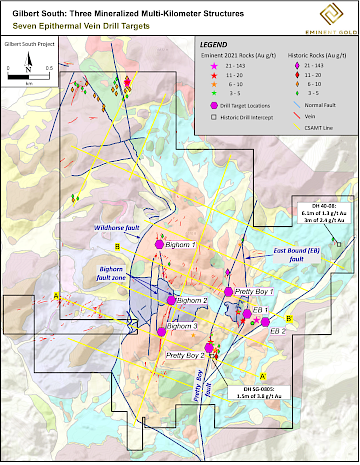

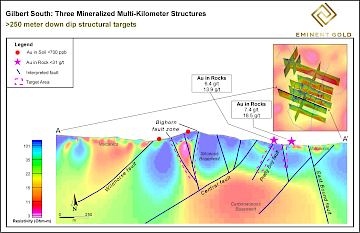

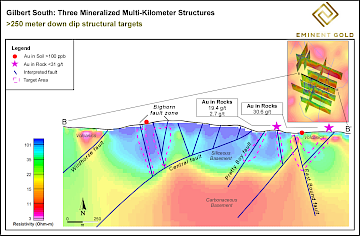

Results from the first phase of rock chip sampling and hyperspectral mapping suggest that the highest grade gold zone in this low sulphidation epithermal gold system may exist just below the surface. Significant gold in rock chip values range from 7.4 g/t up to 143 g/t gold in samples collected across the entire property. Soil results have demonstrated that the 1.5 km wide region in between the 2.5 km long Bighorn and Pretty Boy/EB faults is anomalously mineralized with gold in soils containing <0.70 ppm gold. Surface mapping indicates there are three primary north-south trending fault zones across the property that are associated with gold mineralized epithermal veins: the Pretty Boy-East Bounding fault zone, the Ohio fault zone, and the Bighorn fault zone. All three fault zones are structurally linked components of a right-stepover on a regional fault. This regional fault and related structures are key features of many gold-silver deposits in the prolific Walker Lane mineral trend.

Pretty Boy/East Bounding fault zone targets

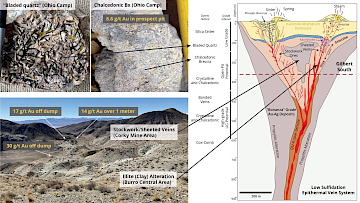

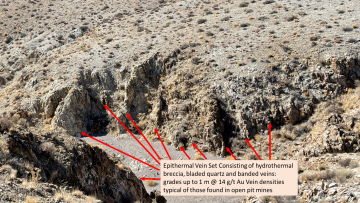

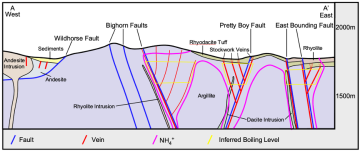

The Pretty Boy and East Bounding fault zone is a 0.75 km wide zone of both stockwork veins and through- going bladed calcite and quartz veins measuring 1-2 meters wide. The exposure of the vein network along strike varies due to topography and post-mineral gravel cover, but individual vein outcrops can be linked for 2.5 km along strike. Vein textures from mine workings and outcrop indicate a very shallow level of the epithermal system is exposed, suggesting that the primary boiling horizon for epithermal system could be preserved at depth.

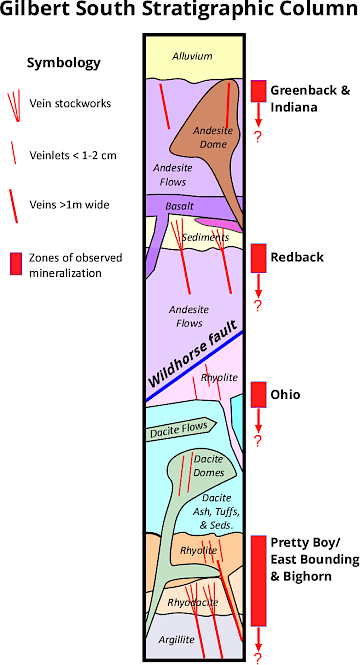

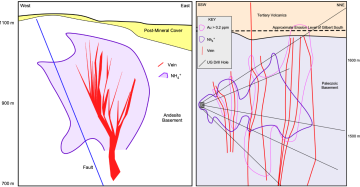

The linked Pretty Boy and East Bounding faults are the focus of the most robust ammonium mineral alteration anomaly as detected by both an airborne hyperspectral survey as well as the handheld spectral survey on individual outcrops. Such an anomaly is interpreted to indicate a zone ~2 km long with a deep-rooted structure serving as the primary conduit for hydrothermal fluids that deposited gold-bearing epithermal veins. The direct link between ammonium and gold mineralization has been documented in other low sulfidation epithermal systems (Figure 7)[6,7,8,9,10,11,12]. The area of the ammonium anomaly is closely correlated with the highest-grade rock samples (Figure 8), as well as a strong gold in soil anomaly which is helping the technical team refine specific drill targets. Typically, rock samples are taken on stockwork veinlets which the Company’s technical team interprets to represent the uppermost portions above the boiling horizon of a larger vein that could be consolidated at depth (Figure 9). As is typical for epithermal systems, the vertical extent of mineralization is controlled by the level of boiling during vein formation, which could extend hundreds of meters down dip. Surface samples are predominantly taken from a welded tuff, which is rather friable and hosts mineralization as numerous stockwork veinlets. At depth the very competent argillite basement rock is a more suitable host for large open fractures and bonanza veins, a feature common to other epithermal systems in Nevada[10].

Bighorn fault zone target

The Bighorn fault zone is characterized by three subparallel faults, the easternmost of which has a semi-continuously exposed calcite vein that averages 1-3 meters wide and is 1.5 kms long. The texture of the calcite vein, rhombohedral to banded, suggests the vein is the very shallowest exposure of an open fissure epithermal vein. At the northern extent of the Bighorn fault zone, the single vein horsetails into numerous en echelon veins within a poorly consolidated rhyolite dome. The strongest gold anomalies in the property wide soil survey confirm the surface expression of this target. Pending interpretations from a geophysical survey currently in progress will serve to image the potential for veins/silicified bodies at depth and that are obscured by the volcanic edifice at the surface.

Ohio fault zone target

The Ohio fault is characterized by a 1 km long fault that traverses relatively benign topography and is thus not well expressed at the surface. One- to two-centimeter-wide quartz veinlets are observed in dump samples from within this fault zone. Historical rock samples include grades of up to 8.6 g/t Au and rock chip sampling by the Company in 2021 provided Au assays from 12.5 g/t up to 143 g/t.

Secondary, Lower-Priority Targets Associated with Mafic Volcanics

The lower-priority vein systems are the Redback, Greenback and Indiana, that all are hosted in the younger sequence of mafic volcanics. The veins from these target areas are typically 1-2 meters wide and are chalcedonic in texture, indicating very shallow preservation above the boiling horizon. Due to the lower apparent concentrations of gold within these targets, and the targets not being clearly associated with a regional structural framework they have been the secondary focus of exploration activity. Again, the pending soil results will yield additional insights for potential at these target areas.

Description of Program

Numerous historic prospect pits that were not on previous maps were discovered during Phase I field work. Following the soil survey (results pending), the Company’s technical team also conducted a 2-week reconnaissance mapping program consisting of field checking existing 1:24,000 scale mapping and rock sampling: numerous channels and chips were taken at existing outcrops near the historic mine workings for which the Company had no or extremely limited data, especially in the Pretty Boy-East Bounding fault area. Two methods of spectral analysis were utilized by the technical team to expedite vectoring to the zones of highest temperature alteration and potential upwelling within the laterally extensive hydrothermal system. The first method used was remotely sensed hyperspectral data, acquired at a 2.5-meter pixel resolution by a fixed wing aircraft that captured >320 bands from 400-2450 nm. This data was acquired, and preliminary processing and interpretation completed by Spectir Advanced Hyperspectral Solutions (https://www.spectir.com/). Their interpretation mapped a widespread illite alteration extending across the property. The preliminary data received final interpretation by Browning Geosciences (https://www.browninggeoscience.com/) that used spectra from field collected samples to be used as ground truth and included in the spectral library for refinement in mineral identification of the remote sensing data. The final interpretation identified multiple anomalies of ammonium illite within the laterally extensive field of illite alteration. Knowing that research demonstrating that ammoniated hydrothermal fluids interact with potassium-bearing minerals in wall work material to form ammonium illite or buddingtonite patterns along deep-seated structural fluid conduits and these same fluids also transport gold(8) the technical team used this as a parameter to vector field efforts. To further verify and refine the ammonium illite anomalies the technical team also conducted a two-week ground based spectral mapping program using an ASD TerraSpec Halo mineral identifier to collect data in real time while traversing the project area. 1953 spectral measurements were taken across an equal number of samples sites. Mineral identification is done automatically by the unit by comparing measured spectral profiles to the USGS spectral library. 193 buddingtonite and 253 ammonium illite sample sites were identified at a >90% confidence level by the machine. A select set of the machine identified spectra were verified for their accuracy by Browning Geosciences and were found to be accurate mineral identifications. Field collected spectra verified the remotely sensed ammonium anomalies and identified which structures were the focus of ammonium illite and buddingtonite.