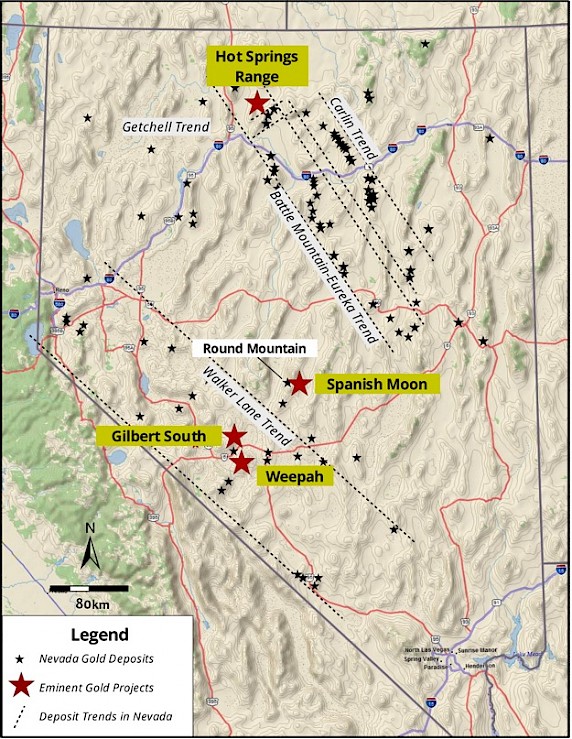

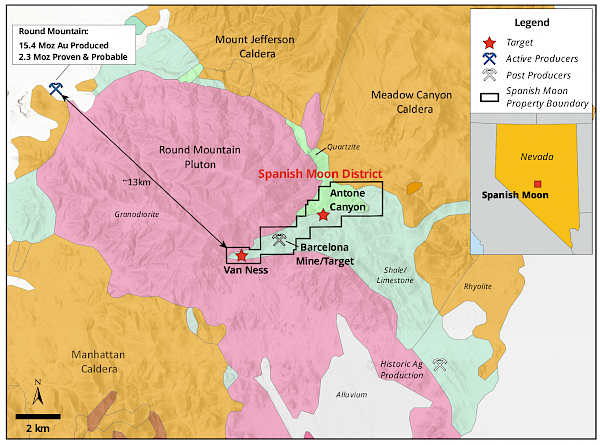

Vancouver, Canada, September 22, 2021 – Eminent Gold Corp. (TSX-V: EMNT) (OTCQB: EMGDF) (the "Company" or “Eminent”) is pleased to announce positive results from its first phase surface exploration program at its Spanish Moon District project (“Spanish Moon”), located approximately 13 km SE of the active Round Mountain Mine with over 15 million ounces of gold produced1,2 (Figure 1, 2). For the first time in the history of this metal rich project, the Company has completed an extensive rock and soil survey across the entire property with results including: 1) a 1 g/t silver (Ag) (+/- gold (Au)) -in-soil anomaly extending from west to east across the property, and 2) results from bedrock, small prospect pits, and the millsite returned values as high as 8520 g/t Ag and 10 g/t Au (Figure 3). Results indicate the existence of three distinct domains of zoned, precious metal mineralization at the Barcelona-Van Ness, Antone Canyon, and Flower target areas. Based on these results the Company plans to conduct a geophysical survey across the entire district as well as generate specific drill targets in the Antone Canyon target, where historic drilling occurred.

Paul Sun, President and CEO of the Company commented:

"The results of the geochemical surveying program have validated our teams’ original model that mineral zoning made the entire project prospective for precious metals and exceeded even our own expectations. Results show that precious metals occur in soil and rocks over the entire length of the property even in areas only previously mined and prospected for mercury and antimony."

Summary of Targets:

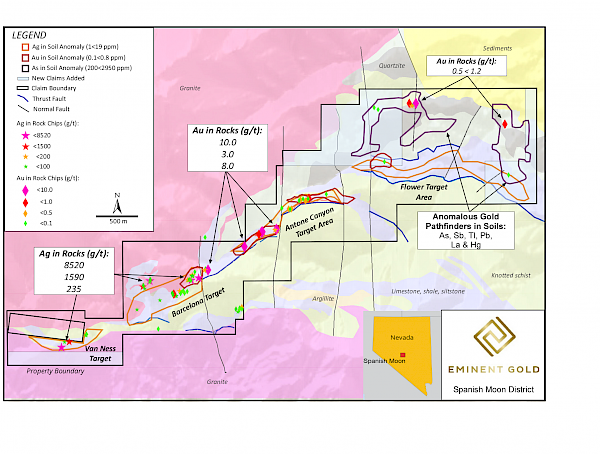

Results from the Phase I sampling and mapping program suggest that there are three distinct and strongly mineralized domains at Spanish Moon; the western Barcelona-Van Ness, the central Antone Canyon and the eastern Flower. The western domain appears to be an intrusion related silver and gold system forming the Barcelona-Van Ness target. The central domain may be a low sulfidation and sediment-hosted gold and silver system forming the Antone Canyon target. The newly identified eastern domain could be a low sulfidation epithermal gold system forming the Flower target. These three domains combined make the entire Spanish Moon District prospective for precious metals. At each of these targets, the strike lengths of known or newly discovered precious metal occurrences have been extended by >1 km. The technical team established very prospective Ag grades (<8520 g/t) in the Van Ness target and continued to find high grade Ag (<1590 g/t) and Au (<10 g/t) at the surface in the Barcelona mine and Antone Canyon target areas. Additionally, the Company identified the presence of Au mineralization in the Flower target, a mercury (Hg) and antimony (Sb) prospect with no historic sampling for Ag or Au.

Results from an extensive soil survey suggest that silver is anomalous (> 1 ppm Ag) across the entire length of the property where typical Ag background values are 0.2 to 0.3 ppm. This silver anomaly occurs within a prospective limestone unit that is capped by a regional thrust fault. The same prospective limestone is the primary host rock to the neighboring historic silver-gold districts of Belmont (>10M oz Ag produced 1868-1887) and Manhattan (>135K oz Au and >50k oz Ag produced 1906-1921).

Barcelona – Van Ness Target

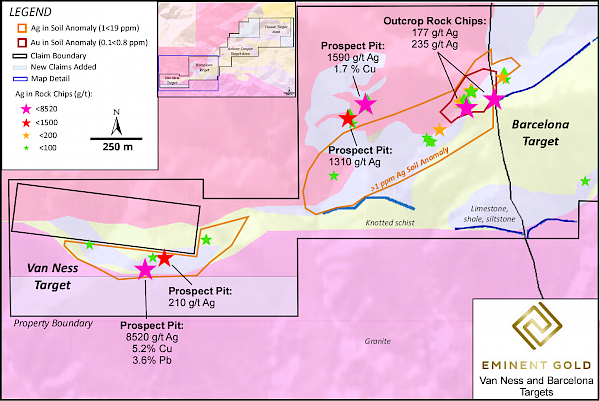

At the historic Barcelona mine area, soil and rock sampling results extended the area of identified silver mineralization to over >1 km west to the Van Ness area, creating a high-grade silver domain in the western third of Spanish Moon (Figure 4). The highest Ag-in-rock sample, came from a small dump at the Van Ness mercury mine, a location not previously associated with precious metals. This sample also contains 5.7% Cu, 3.6% lead (Pb), and 2.4% zinc (Zn). This discovery indicates that high-grade silver mineralization could extend over 1 km from the historic Barcelona mine to the Van Ness workings. Additional samples from small mine dumps and prospect pits at Barcelona delivered assays up to 1590 and 1310 g/t Ag. Rocks from the mouth of a collapsed drainage tunnel and a former mill site at Barcelona delivered values of 884, 688, and 230 g/t Ag. Outcrops and decline rock samples in and surrounding the historic mine portals delivered silver values up to 235 g/t Ag over a 0.3 m width, 177 g/t over a 2.7 m width and 141 g/t Ag over a 1.2 m width.

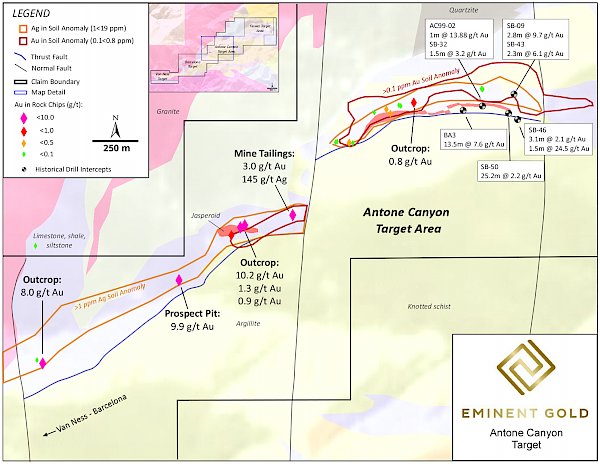

Antone Canyon Target

Phase I results have tripled the strike length of Au mineralization identified at Antone Canyon; extending the occurrence by 1 km to the west of previously known mineralization (Figure 5). In the eastern portion of Antone Canyon previous operators drilled holes with intercepts up to 13.5 m @ 7.6 g/t Au. Rock samples from small prospect pits and outcrops delivered assays up to 10.2, 9.9, and 8.0 g/t Au. The newly identified western two thirds of the Antone Canyon gold anomaly has never before been drill tested and mapping suggests mineralization is focused immediately beneath a thrust fault that is interpreted as a major control on mineralization. The next step at Antone Canyon includes a geophysical survey to define new drill targets. In addition, relogging legacy core from Antone Canyon will offer insight as to whether mineralization has a structural or stratigraphic control.

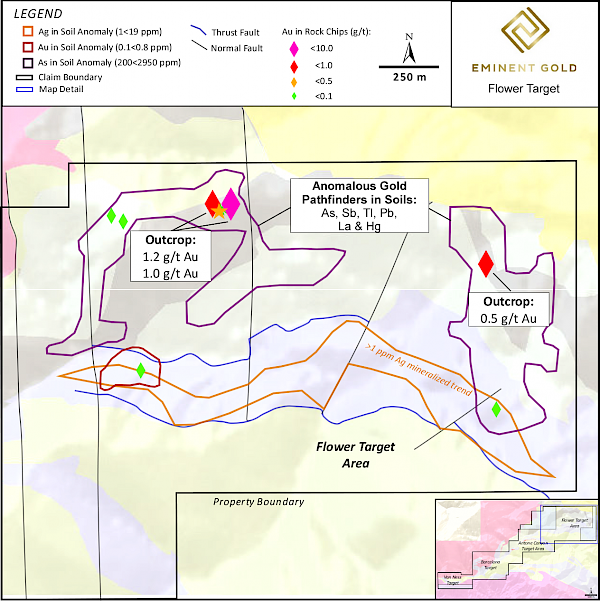

Flower Target

At the eastern end of the district, results of the soil survey in the Flower domain identified two large arsenic (+Sb, Thallium, Hg, Lanthanum, +/-Pb) anomalies covering approximately a 1 km2 in the west and ~0.5 km2 in the east. These soil anomalies are accompanied by Au-in-rock samples of up to 1.2 g/t Au (Figure 6). These rock samples are believed to be the first gold bearing samples in the eastern Flower target area. Reconnaissance mapping suggests the anomalous geochemistry may correspond with steeply dipping normal faults associated with a regional fault that forms the eastern margin of an adjacent caldera. The next steps at the Flower Target will be to refine the structural framework of this apparent volcanic associated hydrothermal system that may be younger and overprinting than the older intrusion related mineralization immediately to the west at Spanish Moon.

Dan McCoy, Chief Geologist and Director commented:

“The results suggest that the Spanish Moon hydrothermal system has delivered both high grades and significant strike length. What were previously isolated occurrences not known for precious metals are proving to be part of a regional scale silver-gold district with three distinct domains each with exceptional potential. We will continue to refine the picture through detailed mapping and geophysics. We expect to have numerous drill ready targets selected for the 2022 drilling season.”

Description of Program

The Company’s technical team soil sampled the Property at 100-meter centers except for the Barcelona area where it sampled at 50 meter centers and the Antone Canyon area, where the Company had already obtained soil results from previous operators. Rather than contract the sampling program out, the Company’s technical team performed the soil sampling itself to better capture the geology (lithologic notes were obtained at each sample site) as well as the alteration and mineralization that occurs outside of the known mine and prospect areas. Numerous historic prospect pits that were not on previous maps were discovered during this process. The Company’s technical team also conducted a 2-week reconnaissance mapping program consisting of field checking existing 1:24,000 scale mapping and rock sampling: numerous channel, chip, and dump samples were taken at existing outcrops near the historic mine workings for which the Company had no or extremely limited data, especially in the Barcelona area. Please see the Company’s website for further detail.

All scientific and technical information in this news release has been prepared by, or approved by Justin Milliard, PGeo. Mr. Milliard is Project Geologist for Eminent and is a qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Some of the information herein is provided by 1) historical reports that describe mining activities, geology and potential, published by the Nevada Bureau of Mines as well as historical field notes and reports recorded in the Nye County records, 2) publicly available reports from Royal Standard Minerals (annual reports and news releases) published on SEDAR between the years of 1997 and 2000 and 3) unpublished summary reports and news releases from Bullion River Resources describing exploration performed between 2003 and 2004. It should be noted that the Company believes that all of these reports are reliable; however, the Company's qualified person has not conducted verification procedures and therefore has not confirmed them.

Figure 1. Location map showing the Spanish Moon District is adjacent to the Walker Lane Trend, Nevada

Figure 2. Regional Geology Map from ArcMap Online data sources showing the Spanish Moon District that encompasses Spanish Moon, Barcelona, and numerous historic mines. Round Mountain gold production, proven and probable values from Patterson (2020)1 and Kinross (2021)2.

Figure 3. Project geologic map showing Ag-in-soil (orange), Au-in-soil (red), arsenic (purple) anomalies as respective polygons. Anomalous Ag (stars) and Au (diamonds) assays from rock chips shown on the map are sourced from one of: mill dump, mine tailings, prospect pit, or outcrop. Subsequent figures display more detailed sample information for each site.

Figure 4. Small scale map of the Van Ness and Barcelona target areas forming the western domain of Spanish Moon. The map shows high grade Ag in rock chip samples along with their respective source location. A Ag-in-soil anomaly greater than 1 g/t is highlighted by the orange polygon trending from SW to NE, and a Au-in-soil anomaly greater than 0.1 g/t is represented by a red polygon. Newly added claims along the southern boundary of the Van Ness target are shown as a light blue polygon.

Figure 5. Small scale map of the Antone Canyon target area forming the central domain of Spanish Moon. The map displays anomalous high-grade Au in rock samples along with their respective source location.

Figure 6. Small scale map of the Flower target area that forms the eastern domain of Spanish moon. Historically this area has not been sampled for Au, Ag, or other pathfinders. The soil results show strong As-Sb-Tl-La-Hg anomalies, highlighted in the purple polygons. The Ag-in-soil anomaly continues through the Flower area and a small Au-in-soil anomaly also occurs. Several anomalous Au in rock samples from surface outcrops indicate the potential for Au mineralization at depth.

References

1Patterson, M. V. a. L. (2020). Major Mines of Nevada 2019: Mineral Industries in Nevada’s Economy. Special Publication P-31. University of Nevada, Reno, Nevada Bureau of Mines and Geology.

2Kinross (2021). "Round Mountain Nevada, USA." Retrieved September 21, 2021, 2021, from https://www.kinross.com/operations/#americas-roundmountain.

On behalf of the Board of Directors,

“Paul Sun”

CEO and Director

For further information on Eminent Gold Corp., visit www.eminentgoldcorp.com, email: info@eminentgoldcorp.com, or call 604-288-8956.

About Eminent Gold

Eminent Gold is a gold exploration company focused on creating shareholder value through the exploration and discovery of world-class gold deposits in Nevada. Its multidisciplinary team has had multiple successes in gold discoveries and brings expertise and new ideas to the Great Basin. The Company’s exploration assets in the Great Basin include: Hot Springs Range Project, Weepah, Gilbert South, and Spanish Moon District.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain statements that may be deemed “forward-looking statements” with respect to the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Forward-looking statements made in this news release include the Company’s exploration plans for the Spanish Moon property, the Company’s expectations for the potential of the Spanish Moon property, the Company’s plans for generating drill targets based on current information and the generation of information from the proposed geophysical survey. Although Eminent Gold Corp. believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, including the assumption that records and reports of historical work on the Spanish Moon property are accurate and correct and that the sampling results are indicative of the target areas as a whole, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, the Company’s ability to raise sufficient capital to fund its obligations under its property agreements going forward, to maintain its mineral tenures and concessions in good standing, the Company’s assumptions may prove incorrect; changes in economic conditions or financial markets; the inherent hazards associated with mineral exploration and mining operations, future prices of gold, silver and other metals, changes in general economic conditions, accuracy of mineral resource and reserve estimates, the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the Company’s projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company’s plans and business objectives for the projects; the general ability of the Company to monetize its mineral resources; adverse weather conditions may affect the Company’s ability to conduct work programs, availability of qualified personnel, changes in environmental and other laws or regulations that could have an impact on the Company’s operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry. Forward-looking statements are based on the reasonable beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.